Tyler Cowen can’t heap enough praise on this paper from Raghuram Rajan.

I am loathe to use such language, but at this late date I think it helps to be direct. The paper reads to me like nonsense on stilts. Ostensibly its about the ineffectiveness of attempts to stimulate demand and induce recovery in advanced Western economies.

By my reading it is a litany of complaints about the current political economy of the United States and Western Europe. If this was story about why real wages are stagnant, why there is widespread social unrest, or why the current state of affairs is simply displeasing to Rajan’s aesthetic then we would have something.

As it stands he pens gems like the following:

The status quo ante is not a good place to return to because bloated

finance, residential construction, and government sectors need to shrink,

and workers need to move to more productive work. The way out of the

crisis cannot be still more borrowing and spending, especially if the

spending does not build lasting assets that will help future generations

pay oª the debts that they will be saddled with. Instead, the best short term policy response is to focus on long-term sustainable growth.

There are many things wrong here but I just want to point out a few that are illustrative of what’s wrong with this entire line of thinking.

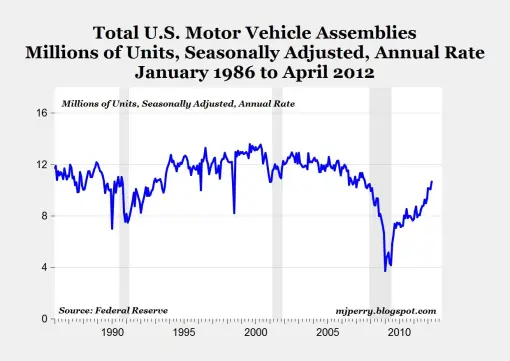

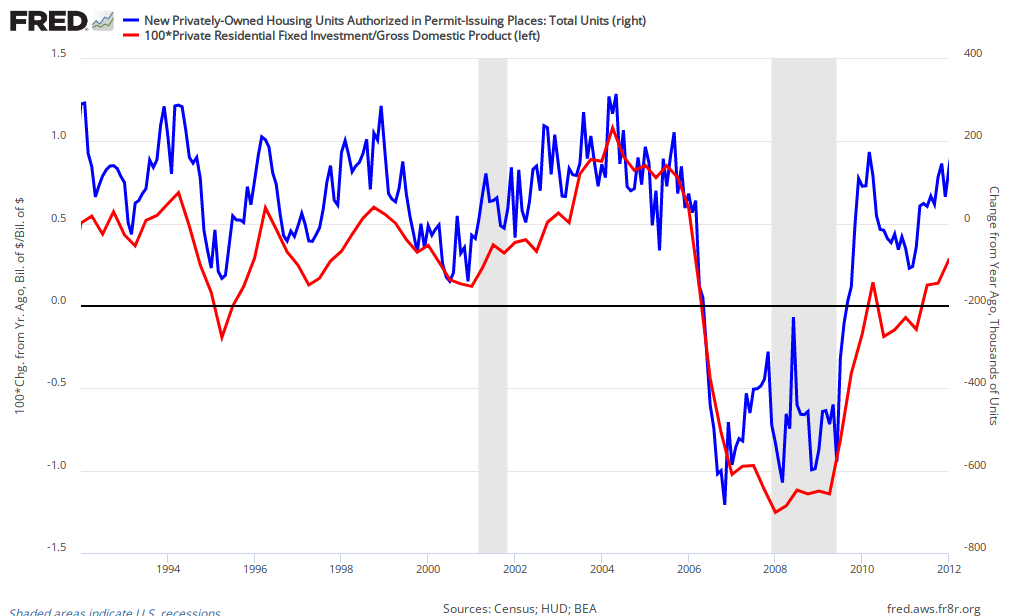

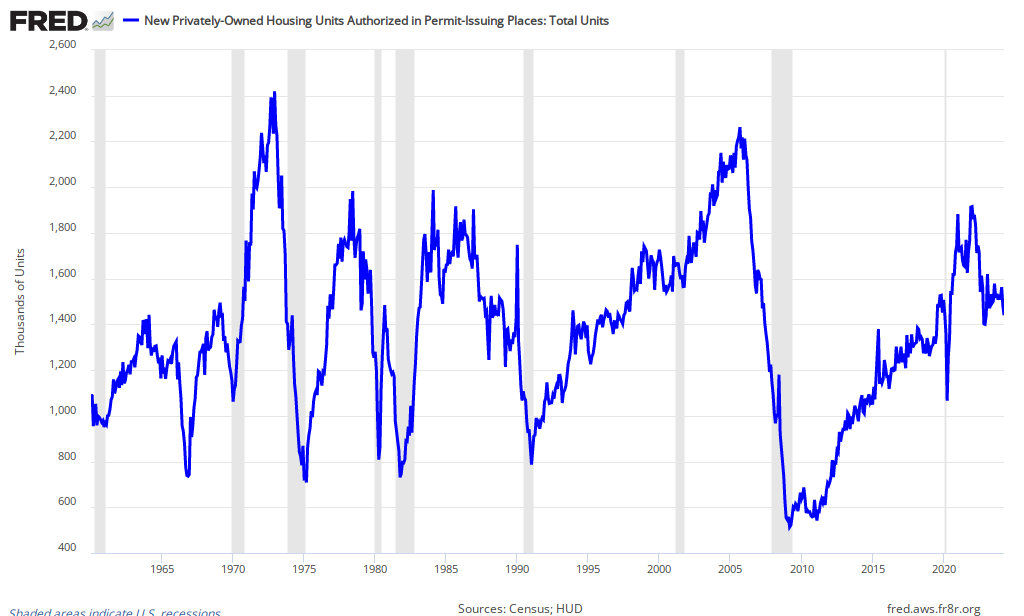

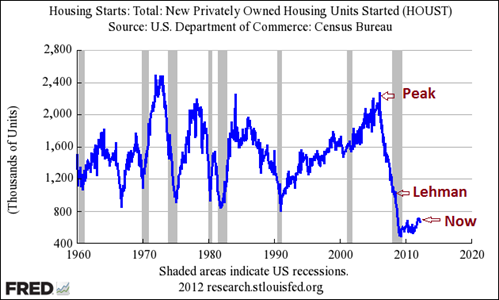

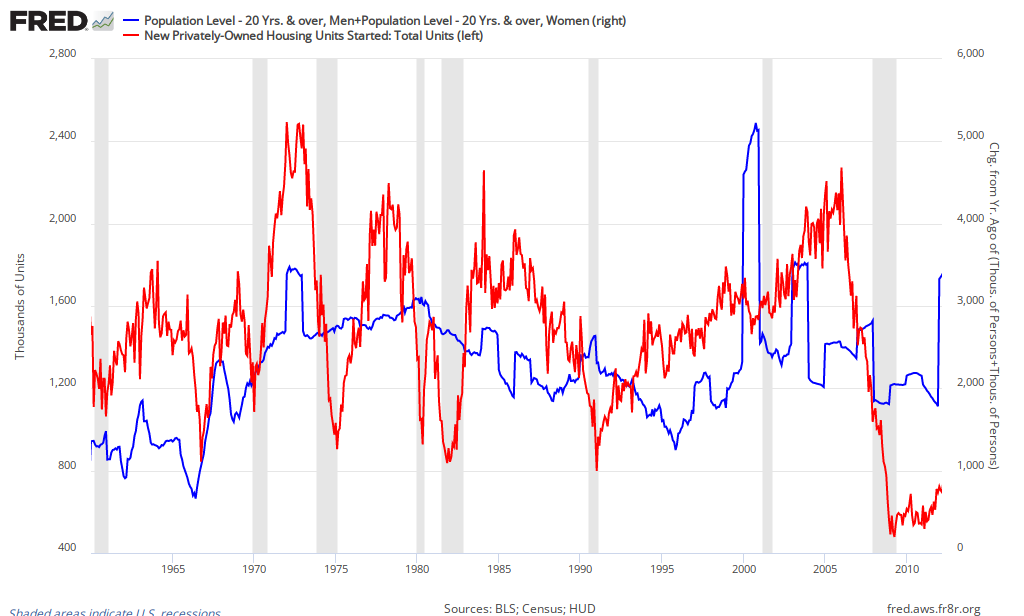

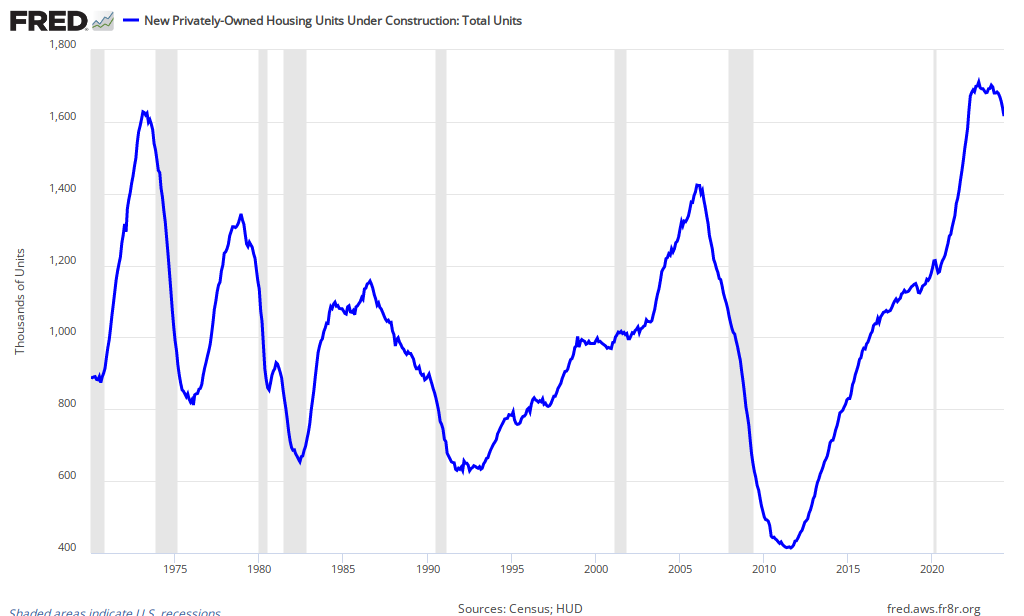

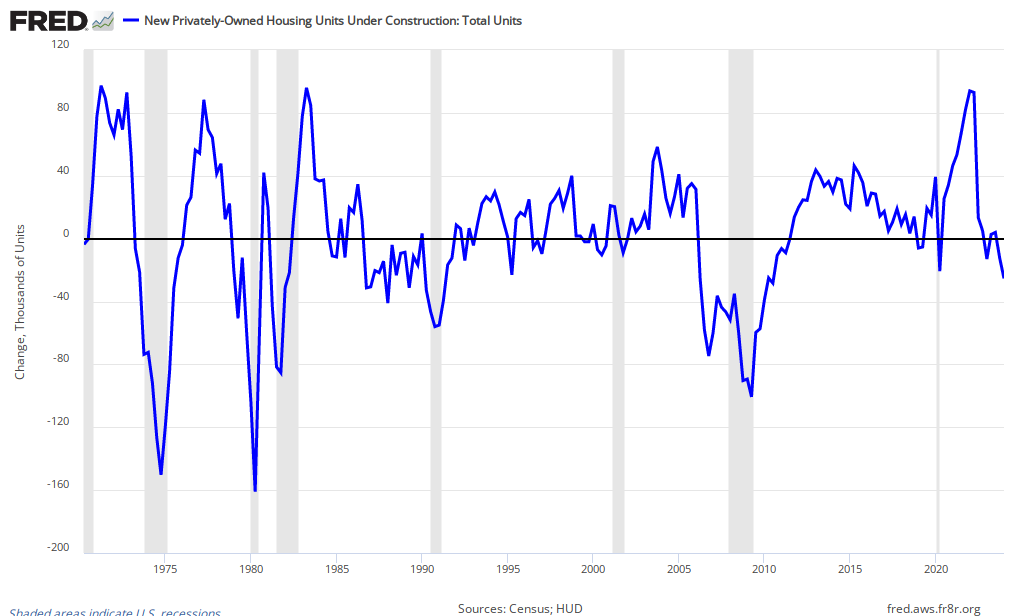

First, we can argue about government and finance, but there is no evidence that the residential construction sector is bloated. A cursory look at actual production levels would tell you that United States is producing far too few homes. If you don’t trust that then you can look at prices. Rents – the price of the service flow from housing – are rising rapidly against a backdrop of depressed demand and high unemployment.

If you wanted to argue that a structural problem facing the United States is the inability of the residential construction sector to jumpstart itself, that would make sense. However, the idea that a problem facing the US is that it is spending too much capital and labor on residential construction is directly at odds with the facts.

This is important because it provides a window in the virtue vs. vice thinking that pervades this piece and much commentary. Vicious activities like buying houses you cannot afford must be replaced by virtuous ones, presumably such learning to be good electrical engineers.

What’s wrong with this type of thinking is not that it heaps blame upon the guilty, but that it encourages intellectuals to get away with slip-shod mechanics. Virtue and vice are human judgments, not actual forces in the world.

Natural phenomena must have natural explanations. This requires tracing down the effects of impersonal forces. And, perhaps actually taking a glance at housing starts or the issues associated with our vacancy rate measures before making pronouncements about which sectors need to shrink.

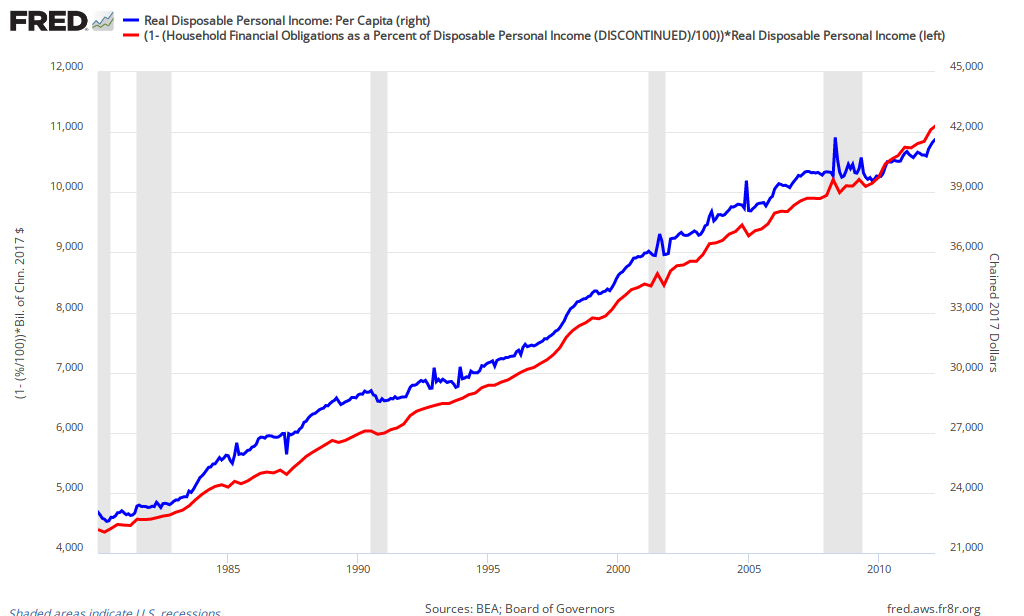

Second, Rajan writes that the way out cannot be more borrowing and spending, yet he makes no clear case why. If I may be so bold, I assume what’s going on here is standard ant-grasshopper prejudice. It’s the notion that consuming evermore without preparing for the future is a pernicious human tendency that must be battled at every turn.

Spending of course is not the same as consuming and Rajan pays lip service to that in his “especially if the spending does not build long lasting assets.” Yet, the “especially” is his confession. If the United States had the opportunity to borrow money cheaply in order to invest in highly productive assets this would not be a countervailing consideration that made it “OK” to borrow. It would be the central consideration and the defining feature of profit maximization.

Yet, even in the case that the assets the US wishes to invest in have a low return, its not clear that this makes borrowing a poor decision. If real interest rates are below zero then the return does not have to be great for the borrowing to make sense.

This is compounded by the fact that very little government spending is done on things that people would consider pure consumption. Most tax funded government workers are teachers, firefighters, law enforcement officers and soldiers. We can argue about the marginal products of these workers but all of them are in the business of creating or protecting capital.

If you are concerned about the future its not immediately obvious that these workers are a drag. To be clear, I am not dogmatically defending them. I am pushing back against the notion that “spending” is somehow equivalent to simply throwing wild devil-may-care parties, all the while passing the bill on to our children.

And again, it must be remembered that the real interest rate is not always positive. Even if all we care about is the children, passing wealth on to them is not always free. It is sometimes – and now is such a time – actually costly to do so.

This is just a fact about reality that people need to accept. Storage is not free. Passing goods and services through time is not free. For Jove’s sake people, this is the principle reason that every living thing dies and every built thing ends in ruins. Its not like its some weird confluence of events that should be difficult to internalize. It is the core struggle of our species.

That the combined forces of the industrial revolution, urbanization and the population explosion gave us a reprieve from these forces should not lull you into thinking that this basic issue has vanished into the ether.

Third, and I will be brief here since this has gone on long enough. Rajan says, “the best short term policy response is to focus on long-term sustainable growth.” Again, I hate to be rude but I have to be direct.

Is this some kind of sick joke?

Is there an area in which our policy initiatives have more consistently failed than in producing long term sustainable growth? Do we even have a consensus on how long term growth got started in the first place? Do we have a solid story to explain growth differentials today?

Is there a policy explanation for why the GDP of Northern California is booming out of control while Maine dies a slow death? Lets not even get started with cross-country comparisons where we can gesture in the vague direction of institutions but still know little-to-nothing about how to produce sustainable ones.

Perhaps, Rajan thinks the milder goal of human and physical capital accumulation is what is needed? Yet, this entire piece is arguing against the massive borrowing that is at the heart of such accumulation. Indeed, the largest single type of capital is housing, which Rajan has dismissed. Over half of the production activity of the government sector is education, which Rajan has said is bloated.

If you don’t want more borrowing or more teachers, what do you want? Perhaps efforts to increase TFP or educational effectiveness.

Welcome to the world!

This is what folks have been desperate for my entire life. If we knew how to get it, we would.

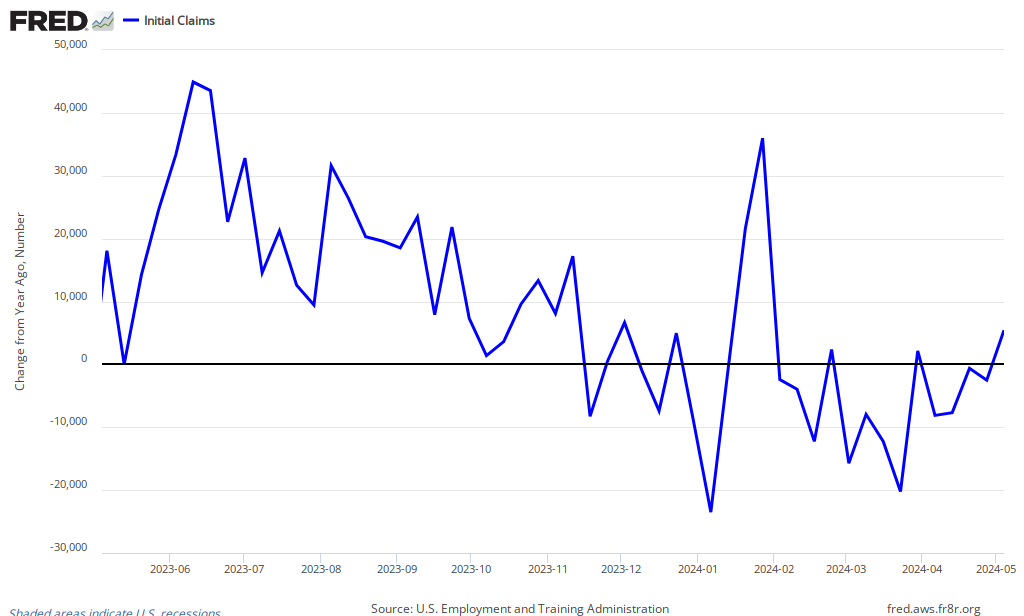

To close, none of this addresses the core issue that markets are failing to clear. If the root of our problems was nothing more than poor skills and over-borrowing then we should expect the dollar to fall, the consumption set of Americans to shrink and the competitiveness of US labor to rise.

The US would be at full employment but could not enjoy the bevy of foreign made goods that it does today. Indeed, Americans would be exporting much of their own production. This would be unpleasant for many and we could talk about moving the US towards a higher productivity society.

However, that is not the current situation. While the dollar has fallen and US manufacturing has risen, the balance of trade remains weighted towards imports. Unless this price changes Americans will either spend beyond their means and go deeper into debt or spend below their means and go into recession.

If the consumption and production habits of the US need to change vis-à-vis the world then prices need to change. This should be the core lesson of recessions and indeed, macroeconomics.